Disciplined, Top-Down Approach to Investing

We generate alpha by uncovering global investment styles and themes where we believe there are disparities between fundamentals and sentiment. This is very different from the traditional, bottom-up approach that seeks to generate alpha through individual security selection.

A Focus on Fundamentals

The RBA investment process focuses on fundamentals – with particular emphasis on corporate profit cycles rather than economic cycles. The investment process centers around hundreds of indicators which fall into three key categories: corporate profits, liquidity and investor sentiment/valuation.

Profits

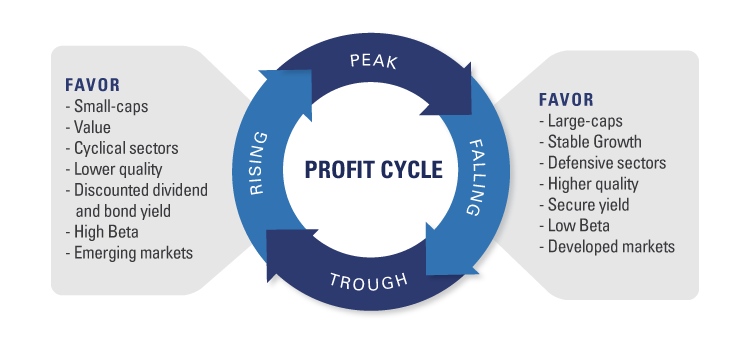

Our research demonstrates that corporate profits are a much stronger determinant of market performance than economic cycles. Thus, global profit cycles are a critical determinant of our country, size, style, quality and sector allocations.

Liquidity

With liquidity being an essential component of global financial markets and economies, we regularly monitor a broad array of liquidity indicators in all major regions and markets.

Sentiment

Returns are greatest when capital is scarce. We use sentiment indicators to identify capital scarcities and excesses. Undervalued assets are, by definition, never well-loved by investors and ignored assets are similarly rarely overvalued.

The origins of our investment philosophy date back to the seminal research we conducted on style investing more than twenty years ago. Our expertise lies in our disciplined process of combining our proprietary, macroeconomic research with quantitative analysis to determine cyclical and secular investment themes, aiming to provide superior, risk-adjusted returns.

Analysis of global profit cycles is a core component of our strategies. We identify inflection points in global business cycles and then allocate appropriately across asset classes, sizes, styles, industries, geographies and themes. Examples of market segments we may favor at various points in the cycle are illustrated below.

Pactive Investing® & X-Raying ETFs

RBA’s investment strategies embrace Pactive® Investing, which is the active management of passive investments, like exchange-traded funds (ETFs). A critical aspect of the approach is “X-raying ETFs,” in which we look-through (or “X-ray”) an ETF to examine its underlying portfolio of constituents instead of treating an ETF like a single security. This more sophisticated method for choosing ETFs allows for a total portfolio view of risk and exposures. Without X-raying ETFs to see what’s beneath the surface, you could get tripped up due to unforeseen exposures.

What We Mean

We look at an ETF’s underlying constituents rather than invest in an ETF as a single security. Understanding how the risks embedded into an ETF could impact our overall strategy guides RBA to select the most appropriate ETF.

How We Do It

ETF issuers publish their holdings daily and RBA examines an ETF’s individual components using state-of-the-art 3rd party tools. We look-through (or “X-ray”) the parent level of an ETF to shape and mold our desired solution.

Why We Do It

X-raying ETFs is critical in understanding the risk of an ETF-based portfolio. Without X-raying ETFs to see what’s beneath the surface, you often end up with unintended exposures.

How to Invest with RBA

Financial Advisors

RBA offers a range of actively managed, tactically driven products available at most wirehouses, TAMPS and RIA platforms.

Institutions

RBA has a suite of strategies providing solutions for complex investment challenges for Institutional Investors.

Individuals

Individuals can invest in RBA’s strategies by working with their Financial Advisor or investing in our mutual funds.

Want to learn more about RBA's investment process?

You can reach our portfolio specialists at 212-692-4088 or send us a message using the form to the right.